How to Budget During Med School

What? I just got my loans. I’m fiiiiiiine.

I don’t need to budget.

It’s August 2020 – and that means brand new medical students are on their way to start school. If you are paying for bills, tuition, books, food, housing and everything else with federal loans then you will be getting a “disbursement” soon. That is a lump sum of money, typically given out twice a year (at the start of each “semester”) to cover the costs of education and living while you spend your time learning basic sciences and eventually clinical skills. And without a solid budget planned out now you may do what I did…

Disbursement Disaster

As a first year, I had never seen such large sums of money in my life. My parents had “regular” jobs and I worked as programmer while a pre-med, but I’d never even had $2000 sitting in my bank at one time (except maybe the day before rent was due).

I constantly spent more than I made, maxed out credit cards and lived a financially foolish life. Enter me, a financial noob, to medical school and get a direct deposit of $27,000? Every disbursement I felt like I was rich. I would get myself new clothes or buy my husband a new videogame, ordered stuff from Amazon all the time. Of course, I “needed” it all, because it was always “for school” or “for relaxing.”

I did my budget in Excel, but I’d screw up because I was tired (first year will cause fatigue) and not realize until the end of the semester when we were six weeks from a check and didn’t have enough money to last. This was an absolute disaster and an ignorant way of dealing with money. It’s not like my parents didn’t try to teach me to do better. I just believed my way was fine. And didn’t learn from my repeated mistakes. Unlike before, when I had a job and could just do more work, I had no way to fix it when i screwed up. So, we’d struggle to pay bills and keep doing the minimum payment on credit cards until the next disbursement. Ramen and oatmeal diet, ad nauseum. And if he hadn’t had a job? Oh jeez.

Be Smarter than Me!

So, obviously if I’m writing this I have a suggestion for a better way. It’s got a meh name, but it’s a good service. It is NOT free. It’s called You Need a Budget (YNAB) and it focuses on getting you to think about the money you have, not what you will have, and PLAN FOR EVERY DOLLAR YOU WILL SPEND. First, yes, it’s $84 a year, BUT you get a free month during which you budget for that cost, or you can pay monthly $12.

Considering how disbursement works, this type of budget is great for medical students. The main benefit is the ability to take that large check and plan out all your known expenses, but also allocate funds for expenses you know will happen but can vary. It also lets you set goals for credit card payoff (if you have an employed partner who can work toward this, not something to use loan money for).

How does YNAB Work?

Whenever you get “paid” (ie: get disbursement, or a deposit in your Venmo), you “budget” for every little thing that may come up. Whenever you spend money you use the app (on your Android/iPhone or computer) to enter it and assign a category, pulling money from the budget pool.

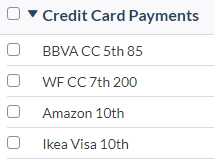

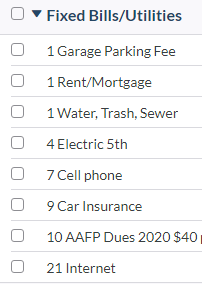

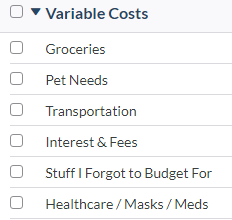

It lets you build category groups so you can keep similar things together. We use Credit Cards, Fixed Monthly Bills, Variable Monthly Bills, Annual Expenses and Quality Of Life/Optional Expenses. More on this at the end of the post.

Change how you THINK about money and your budget

But the real beauty of this is when things change it’s OK. We overspent on groceries last month (probably because I keep going to an over-priced neighborhood market instead of the grocery store… for chips and guac I don’t need) and I just moved money from our “Stuff I Didn’t Budget For” category to cover it. YNAB talks a LOT about how they’re different, but learning to do a few minutes of daily budgeting and start working towards having a longer “age of money” totally changed how we spend.

Juggling credit cards?

Another thing I like is if you use your credit cards for something it will automatically “take” money from your budget for that thing (ie: automated Netflix subscription) and apply it to the credit card for the future payment. It “knows” that money is budgeted for and moves it for you. Now, if you have credit card debt you have to tweak things a bit, but the walk through videos and first month of emails really teach you everything you need to know.

Shared Account, no Extra Fee!

You and a partner can share the account on different devices and track the budget together, if you’re that kind of couple. We are not, for our emotional sanity. So I manage the household finances and husband manages details and we touch base about once a week.

Give it a free trial

So, try it out for a month, and if you have “extra” remember in fourth year you’ll need money for application fees in ERAS, a new interview suit (you’ll gain or lose weight, it happens) and transportation to all your interviews. So plan for that friends! As of today the free trial is 34 days.

Examples of Categories for your Budget

For credit cards I put the date they’re due and a minimum payment as part of the name, to help me keep track.

For bills that are the same amount every month they go in Fixed Bills and I sorted them by date due as the start of the name.

The monthly bills that can vary wildly go here. I set a budget for groceries, but I might spend less than that goal. I don’t always have pet need expenses (we get big bags of cat food), but having a buffer by using the same amount each month helps me have money if I want to get them a silly catnip toy.

Masks are a new budget item, and variable as all heck.

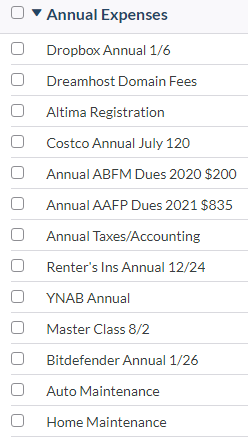

Annual expenses are the ones I used to be the worst at budgeting for. With a disbursement you can plan ahead for your annual car registration fee, Sam’s club / Costco membership in one go. Again, I try to put when it will be due as part of the name, so I remember to pay for it on time.

Now that we have regular income I instead figure out how much I need to budget per month for each of these, and by the time the year comes up the money is “saved” within the budget. MAGICAL.

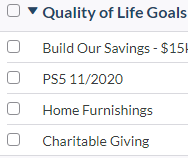

Some things are not “needs” but wants. As you can see, husband wants a PlayStation 5 this year and it’s probably coming out in November. That sucker will cost a lot, so we need to budget for it now, to be sure we can afford it.

This is NOT a sponsored post

I have been using YNAB since February and paid off all our credit cards FINALLY. Yes, part of this is thanks to attending pay, but I also became more thoughtful about making purchases and choosing to save rather than use a credit card. Both myself and my husband had immature spending habits that have evolved – by changing how we think about our money.

Previously I’d used Mint, Daily Budget and loads of apps to try to get better with no change. YNAB was the first one that made a difference in how much we saved. If it starts to suck, or charges too much, I will be the FIRST to pull this post down. But for now, I encourage you to try it.

I’m so glad I found this post. I have been using YNAb for a month now, and find it extremely useful. I’ll be entering medical school in Fall 2021. My goal is not to take out the maximum amount of loans given, so how can I use this budgeting tool to figure out how much money I need to take out? I’m thinking that I will take out the maximum, and then returning the remaining amount (after I figure out my exact expenses during the first month of school). What do you think?

Sorry for delayed response – this varies depending on what other resources you have (good credit and low use, several cards to use? family who can loan you money? savings?) or, if loans are your only resource. If the latter, I’d consider taking full loans, but using YNAB to avoid excess or frivolous spending. Also, YNAB lets you start planning for future expenses like USMLE/COMLEX exams 1-3, ERAS application fees, costs of interviewing (need a new suit? your old one might not fit in 3 years), and the big chunk you’ll need to move to residency (possibly out of state or across the country, deposit and first 1-2 months rent on apartment, etc). – PJ